Your Guide to Bat, Raccoon, & Skunk Cleanup with Homeowners Insurance

Complete Guide to Getting Wildlife Damage Covered Through Your Homeowners Policy

If your home has been affected by bats, raccoons, or skunks, navigating the insurance process can feel overwhelming. This guide walks you through exactly how to get the cleanup and damage restoration covered by your homeowners insurance. We'll start by reviewing the most common reasons insurance companies deny these claims—and how to counter them. Then, we'll walk you step-by-step through how to build and submit a strong claim. Finally, we'll show you how insurance companies view wildlife damage, and why you may be more entitled to coverage than they want to admit. With the right strategy and support, you can protect your health, your home, and your wallet.

Common Reasons Insurance Companies Will Deny Your Claim

When dealing with a bat, raccoon, or skunk infestation, it can be frustrating to discover your insurance provider is hesitant or unwilling to pay. These are the most common excuses—and how to counter them:

"It’s a pest control problem."

Insurance companies may lump bats, raccoons, and skunks

in with rodents and insects. This is incorrect. These animals are wildlife protected under federal

and

state law—they cannot be exterminated and must be humanely excluded.

"It’s a maintenance issue."

Many insurers will claim that holes in the roof or

unsealed

vents are signs of neglect. In reality, even brand-new homes are vulnerable to

infestations.

Tiny gaps can let in animals, and your duty is to act promptly once discovered—not to predict the

intrusion.

"We don’t cover removal."

You’re not asking for removal. You’re claiming the

damage caused—guano-stained insulation, urine-soaked drywall, contaminated HVAC,

and severe

odor.

Stay calm, professional, and informed. Know your rights and focus your claim on damage, not pest removal.

Step-by-Step Guide for Bat, Raccoon, and Skunk Insurance Claims

Though all the situations are not the same. Depending on the complexity the cleanup process may vary. Yet, The basic process we follow:

Notice any signs like scratching noises, droppings, stains, or odors? Don’t ignore them. These could be the early warning signs of a serious wildlife intrusion.

Inform your insurer about the wildlife-related damage. Ask directly if your policy covers damage caused by wild animals such as bats, raccoons, or skunks.

Our experts will inspect the situation, assess the damage, take photos, and start building a solid claim for your insurance adjuster.

Have your policy number, claim number (if opened), and adjuster contact info ready. Share these with PDQ so we can communicate directly with your insurance provider.

Avoid saying things like:

-

“We’ve had this issue for a while..."

-

“I know it’s covered…”

Stick to factual, recent discoveries. You want to avoid any hint of neglect.

Use clear, informed rebuttals:

-

"These are federally protected wild animals, not pests."

-

"We're claiming cleanup and restoration, not just removal."

We’ll manage the paperwork, coordinate inspections, and handle adjuster calls. Our goal is to get your home restored to its pre-damage condition using your existing coverage.

Once approved, our team gets to work. We remove contamination, repair damage, eliminate odors, and ensure your home is safe, clean, and resale-ready.

How Insurance Companies See Bat, Raccoon, and Skunk Damage

Insurers Focus on Cost Control

They will initially deny

coverage

unless damage is undeniable. That’s why documenting everything (photos, odors,

sightings) is

crucial.

The HO-3 Policy Trap

Most policies say they don’t cover damage from "birds,

vermin,

rodents, or insects." Insurers may try to squeeze bats, skunks, or raccoons into these categories.

But

legally, these species are ambiguous or excluded from those terms. Courts have

ruled that

protected wildlife does not fall under the “vermin” umbrella.

Why They Should Pay

Insurers save money in the long run by covering early

cleanup. The

longer guano or urine sits, the more damage spreads. Cleaning and sealing now is far cheaper than

mold

remediation, hospital bills, or lawsuits later.

Real Risks Include:

-

Rabies exposure (especially from raccoons and bats)

-

Histoplasmosis (from bat droppings)

-

Roundworm (from raccoon feces)

-

Major property damage (rotted wood, collapsed insulation, stained drywall)

-

Decreased home value (infestations must be disclosed upon sale)

Frequently Asked Questions about Bat, Raccoon, and Skunk Cleanup with Insurance

Dealing with bats, raccoons, or skunks in your home can be stressful, and insurance claims often make it even more confusing. To help, we’ve pulled together answers to the most frequently asked questions about coverage, claim denials, documentation, and the restoration process. This section will give you clear, straightforward guidance so you know what to expect—and how to respond—when your insurer pushes back..

Yes, homeowners insurance can cover bat cleanup and damage restoration—but how the claim is presented makes all the difference. Insurance companies often try to deny bat-related claims by calling it a “pest control issue” or a “maintenance problem.” This is misleading. Bats are federally protected wildlife, not pests, and even well-maintained homes can suffer infestations through tiny gaps or vents.

The key is to focus your claim on the damage caused by bats, not the removal. Bat infestations often leave behind guano-stained insulation, urine-soaked drywall, contaminated HVAC systems, and lingering odor contamination. These are health and property hazards, not routine pest problems. When properly documented, this type of cleanup typically falls under the “sudden and accidental damage” language in most homeowners policies.

It’s also important to note that while many HO-3 policies exclude “birds, vermin, rodents, and insects,” courts have repeatedly ruled that bats do not fall under the definition of vermin. That means insurers cannot automatically deny coverage using this exclusion.

To strengthen your claim:

-

Document everything (photos, odors, droppings, damage).

-

Avoid statements that suggest long-term neglect (stick to recent discovery).

-

Emphasize restoration, not removal—you’re asking for coverage to make your home safe, clean, and livable again.

With the right approach—and professional support—bat cleanup costs can be covered by your homeowners insurance, saving you thousands while protecting your health and property.

Homeowners insurance usually won’t pay for raccoon trapping or removal, but it may cover the repairs and cleanup after the raccoons are gone. This can include replacing damaged insulation, fixing chewed wiring, repairing torn vents or roofing, and removing hazardous contamination from urine or feces.

One important thing to know: raccoons are a high-risk animal when it comes to health and safety. Their droppings can contain roundworm eggs that spread easily through dust, and raccoons are also one of the top carriers of rabies. For these reasons, insurance companies may be more willing to pay for cleanup if you clearly document the health dangers and property damage.

If you discover raccoon activity in your home:

-

Act quickly. The longer they stay, the more damage (and contamination) spreads.

-

Keep records. Photos, videos, and inspection reports are strong evidence for your claim.

-

Highlight safety risks. Emphasize the potential exposure to diseases, not just the damage.

So while you’ll likely need a wildlife professional to handle the actual removal, your homeowners insurance can help with the costly restoration afterward—especially if you present it as a necessary step to make your home safe and livable again.

While most policies won’t specifically list “skunk removal” as a covered item, homeowners insurance often does cover the damage caused by skunk odor contamination. This is because skunk spray doesn’t just smell bad—it’s a chemical irritant that can soak into drywall, insulation, flooring, and HVAC systems. Left untreated, it can make a home unsafe to live in and significantly lower its resale value.

If a skunk has sprayed inside or under your home, insurance may pay for:

-

Odor remediation (specialized cleaning and deodorization)

-

Replacement of contaminated insulation or drywall

-

HVAC cleaning to remove odor particles from ducts

-

Repairs to entry points where the animal got in

To strengthen your claim:

-

Document the odor and where it spreads (especially if guests or neighbors notice it).

-

Act quicklybefore the smell permanently damages building materials.

-

Emphasize habitability. Insurance companies are more likely to pay when the contamination makes your home unlivable.

So while insurance usually won’t pay for a wildlife control company to trap the skunk, it often will help cover the expensive cleanup and repairs needed after an odor incident.

Insurance can cover wildlife damage, but every policy has gray areas. What many homeowners don’t realize is that insurers often look at two factors before deciding:

-

Was the damage sudden and accidental?

If the intrusion happened recently and you acted quickly, you have a stronger case. Waiting months to report it may give your insurer grounds to claim “neglect.”

-

Does the damage affect habitability or safety?

Insurers are more likely to approve coverage when wildlife damage makes your home unsafe—like contamination in HVAC ducts, structural weakening, or odor that makes rooms unlivable.

It also helps to know that insurers think in terms of cost prevention. They would rather pay for early cleanup of bat guano or raccoon droppings than deal with mold remediation, medical bills, or lawsuits later. Framing your claim as an urgent health and safety issue—not just a nuisance—can make a big difference.

Finally, remember that not all wildlife claims are equal. For example, a skunk spraying inside your crawlspace may be treated differently than squirrels chewing wires. Always check your specific policy language, and have an expert help document the case so your claim is harder to deny.

Don’t Wait—Call the Experts

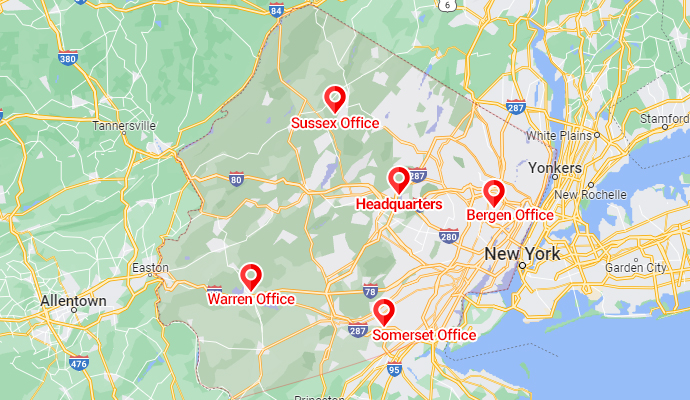

PDQ Restoration works directly with insurance carriers across Northern New Jersey, from Summit to Boonton, Randolph to Montville. Our team documents, negotiates, and remediates wildlife-related property damage quickly and effectively.

Don't hesitate—call us now at 973-447-3363 or contact us online to schedule a consultation.