Insurance Claim Help: From Water Damage to Commercial Losses

Filing an insurance claim after a disaster can feel overwhelming. Whether you’re dealing with water damage, fire loss, wildlife contamination, or even a large commercial claim, the process can be confusing—and insurance companies don’t always make it easy.

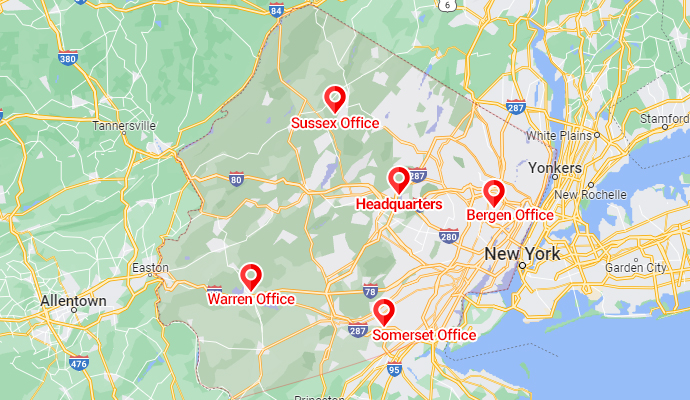

At PDQ Restoration, we help New Jersey homeowners, renters, and business owners navigate the complex world of home insurance claims. Our team documents your loss, negotiates with adjusters, and works to get your property restored with minimal stress.

Water Damage Insurance Claims

One of the most common questions we hear is: Does homeowners insurance cover water damage? The answer depends on the cause. Most policies cover sudden and accidental events—like burst pipes, appliance leaks, or water heater failures—but may deny gradual leaks or flooding from outside sources.

We guide you through every step of your water damage insurance claim, including:

- Documenting structural damage, soaked belongings, and hidden moisture.

- Communicating with adjusters about coverage for drying, repairs, and replacement.

- Helping renters understand when does renters insurance cover water damage? applies.

With PDQ Restoration on your side, you’ll know exactly how to present your claim and maximize coverage.

Fire Damage Insurance Claims

After a fire, homeowners often ask: Does homeowners insurance cover fire damage? In most cases, yes—fire is a covered peril. Homeowners policies usually pay for structural repairs, smoke and soot cleanup, personal property replacement, and even additional living expenses if you can’t stay in your home.

If you rent, you may wonder: Does renters insurance cover fire damage? Renters policies generally cover personal belongings, while the landlord’s insurance handles the structure itself.

We specialize in filing and negotiating fire damage insurance claims, including:

- Kitchen, electrical, and heating-related fires.

- Smoke and odor cleanup.

- Water damage from firefighting efforts (sometimes filed under water damage insurance too).

Fire damage insurance claim tips: Act quickly, document losses thoroughly, and ask about advance payments for housing and essentials.

Commercial Insurance Claims

Businesses face unique challenges when filing commercial insurance claims. Beyond repairing the physical damage, you may also need coverage for business interruption, lost revenue, and equipment replacement.

PDQ Restoration helps business owners:

- Document fire, water, or storm damage to commercial property.

- Work with insurance adjusters to protect against undervalued claims.

- Restore facilities quickly so business operations can resume.

Commercial claims are often larger and more complex than residential ones. Having experts who know how to negotiate is critical to ensuring your company gets the coverage it needs.

Bat, Raccoon, and Skunk Insurance Claims

Wildlife intrusions can cause severe damage and contamination. From bat guano in the attic to raccoon feces or skunk odor, these issues are hazardous to health and property value.

Insurers often try to deny these claims, calling them “pest control” problems. But bats, raccoons, and skunks are protected wildlife, not rodents or insects. That means cleanup and restoration often qualify under your home insurance claim.

PDQ Restoration helps by:

- Documenting contamination with photos and inspection reports.

- Arguing against denial tactics by focusing on damage restoration, not removal.

- Managing adjuster communications to get approval for full cleanup and repairs.

With our support, your wildlife-related claim is more likely to succeed, restoring your home to a safe and livable condition.

Frequently Asked Questions about Insurance Claims

Insurance claims can feel stressful, especially after fire, water, or wildlife damage. Acting quickly and understanding your policy can make the process smoother and help you get the coverage you deserve. Below are some of the most common questions our customers ask about insurance claims, along with expert answers from the PDQ Restoration team.

A fire damage insurance claim begins when you notify your insurer. An adjuster inspects the damage, determines the cause, and reviews your policy. Covered costs often include cleanup, smoke removal, structural repairs, and temporary housing. Keeping receipts and documenting everything are key fire damage insurance claim tips to avoid delays.

Commercial insurance claims often cover more than just building repairs. Depending on your policy, coverage may include business interruption, equipment replacement, inventory loss, and even payroll protection. Because these claims are complex, having experts negotiate ensures your business gets the full benefits available.

Water damage insurance usually applies to sudden, accidental events like burst pipes or appliance leaks. It does not cover flooding from outside sources or long-term leaks. Filing quickly, documenting everything, and working with professionals can help maximize your payout.

Yes—damage from bats, raccoons, or skunks may be covered. These are protected wildlife, not pests, so cleanup and restoration often fall under your home insurance claim. Insurers may deny at first, but focusing on contamination and structural damage—not removal—strengthens your case.