Water Damage Insurance Explained: Does Homeowners Insurance Cover Water Damage?

When water damages your home, one of the first questions you ask is: Does homeowners insurance cover water damage? The answer depends on the type of water loss, your specific policy language, and how quickly you act.

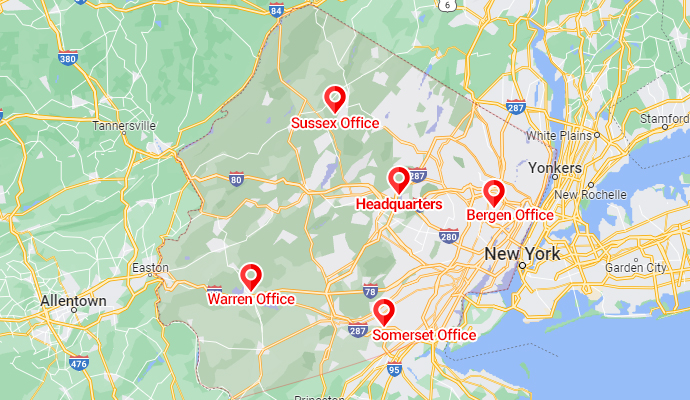

At PDQ Restoration, we help New Jersey homeowners and renters navigate the complicated world of water damage insurance claims. From burst pipes and appliance leaks to storm-related damage, we’ll guide you through what’s typically covered—and what insurance companies often try to deny.

Does Homeowners Insurance Cover Water Damage?

Most standard homeowners insurance policies cover sudden and accidental water damage—such as a burst pipe, washing machine overflow, or water heater failure. However, they often do not cover damage that results from neglect or long-term leaks.

For example, if your dishwasher hose suddenly bursts and floods the kitchen, that’s usually covered. But if a slow leak dripped under your sink for months before being noticed, insurers may deny the claim as “lack of maintenance.”

That’s why filing your home insurance water damage claim correctly matters. Documentation, timelines, and how you describe the incident can all influence whether you get paid or denied.

Does Renters Insurance Cover Water Damage?

If you’re renting, you might be wondering: Does renters insurance cover water damage? Renters policies typically cover your personal belongings damaged by sudden and accidental water events—such as soaked furniture, ruined clothing, or damaged electronics.

However, the structure itself (walls, ceilings, floors) is the landlord’s responsibility. In this case, their property insurance should cover building repairs, while your renters policy protects your items.

Common Reasons Insurance Companies Deny Water Damage Claims

Insurance companies often look for ways to limit payouts. Here are common denial tactics:

- Claiming it’s maintenance-related: Long-term leaks are often excluded.

- Calling it “flood damage”: Standard policies exclude floods—separate flood insurance is required.

- Blaming pre-existing issues: If they argue you knew about a leak and didn’t fix it.

- Minimizing contamination: Insurers may only want to cover part of cleanup, not full restoration.

Understanding these tactics helps you prepare stronger water damage insurance claims.

Water Damage Insurance Claim Tips

If you need to file a claim, follow these steps to improve your chances of success:

- Act Fast – Stop the source of water immediately and call for professional help.

- Document Everything – Take photos, videos, and notes of the damage.

- Avoid Blame Language – Don’t admit neglect; describe the event as sudden and recent.

- Contact Your Insurance Company – Report the damage quickly and request a claim number.

- Work with PDQ Restoration – Our experts handle inspections, documentation, and communication with your adjuster.

With the right strategy, you can maximize your water damage insurance coverage and restore your home faster.

Frequently Asked Questions about Water Damage Insurance Claims

Water damage should always be taken care of quickly to avoid further damage. If it is not handled right away, water damage can cause significant harm to yourselves and your properties. Here are some frequently asked questions that our customers often ask our experts.

Insurance covers water damage when the loss is sudden and accidental—such as a burst pipe, water heater failure, or washing machine overflow. It usually does not cover gradual leaks, poor maintenance, or flooding from outside sources (which requires separate flood insurance).

When you file a water damage insurance claim, an adjuster inspects the property, determines the cause, and estimates repair costs. Coverage often includes drying, odor removal, and repairs to walls, flooring, and personal belongings.

Helpful tip: Many policies require you to take steps to prevent further damage(like shutting off the water supply, drying out the area, or calling a restoration company). If you don’t act quickly, your claim could be reduced or denied.

Another thing to check is additional living expenses (ALE) coverage.If your home is unlivable during repairs, ALE can help pay for hotel stays, meals, or temporary housing.

To improve your chances of approval, document everything, report the issue quickly, and highlight that it was unexpected. With the right approach, your home insurance water damage policy can cover far more than you think.

Most standard home insurance water damage policies only cover sudden, accidental incidents. That means several types of water damage are not covered by insurance, including:

-

Flooding from outside sources (rivers, storms, groundwater) — requires separate flood insurance.

-

Gradual leaks from plumbing, roofs, or appliances that go unrepaired.

-

Maintenance issues like failing to replace old pipes, worn-out roofing, or broken sump pumps.

-

Sewer or drain backups— unless you’ve added a special rider or endorsement.

-

Mold damage that develops over time due to neglect.

Helpful tip: Many homeowners don’t realize they can add optional coverage for things like sewer backup or sump pump overflow. Reviewing your policy and adding these endorsements can save thousands if disaster strikes.

In short, while water damage insurance is designed for unexpected events, anything linked to neglect, long-term wear, or excluded risks like flooding will usually be denied.

A water damage insurance claim may be denied if the insurance company believes the damage was preventable or excluded under your policy. Common reasons include:

-

Long-term leaks– If water damage developed slowly (like a drip under the sink for months), insurers often call it neglect instead of a sudden loss.

-

Poor maintenance– Claims may be denied if old pipes, roofs, or appliances were not properly cared for.

-

Excluded causes– Standard home insurance water damage policies don’t cover flooding, sewer backups, or groundwater unless you have special coverage.

-

Delayed reporting– Waiting too long to file your claim can raise red flags and reduce your payout.

Insufficient documentation– Without photos, reports, or proof of sudden damage, insurers may argue against your claim.

Helpful tip: If your claim is denied, you can often appeal with additional documentation or work with a restoration company that understands water damage insurance claim tips. Having expert support can make the difference between a denial and an approved payout.

Insurance companies consider water damage significant when it impacts the structure, safety, or livability of your home. This goes beyond a small spill or minor leak. Examples include:

-

Warped or rotted flooring from prolonged moisture.

-

Water-soaked drywall or ceilings that need replacement.

-

Mold growth caused by standing water.

-

Electrical or HVAC system damage from exposure to moisture.

-

Contamination from sewage, floodwater, or chemicals.

Helpful tip:Even if damage looks minor, hidden issues (like moisture inside walls or under flooring) can become major over time. Using a restoration company to document these hidden risks strengthens your water damage insurance claim and prevents costly denials later.

Why Choose PDQ Restoration for Insurance Claim Help?

At PDQ Restoration, we’ve helped countless NJ homeowners and renters successfully handle home insurance water damage claims. We know the process, the loopholes insurers use, and how to fight for fair coverage.

Our team will:

-

Document your damage with professional reports

-

Communicate directly with your insurance adjuster

-

Negotiate for full cleanup, repairs, and restoration

-

Restore your home to safe, livable condition