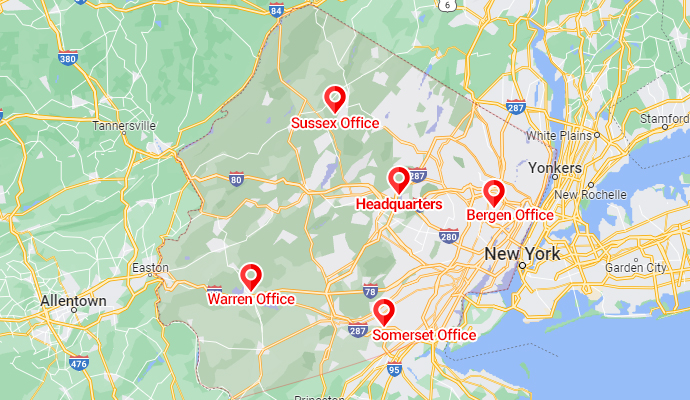

Commercial Damage Insurance Claims in New Jersey

At PDQ Restoration, we specialize in handling complex commercial water damage insurance claims and commercial fire damage insurance claims. When a disaster impacts your business—whether from flooding, broken pipes, sprinkler malfunctions, or fire-related water damage—our team provides expert commercial water damage restoration services to get you back up and running quickly.

We know that downtime costs money. That’s why we move fast to document losses, protect your property, and communicate directly with your insurance adjuster. From small retail spaces to large industrial facilities, PDQ Restoration has the knowledge and experience to manage your commercial damage insurance claim from start to finish.

Commercial Water Damage Insurance Claims

Commercial water damage can strike suddenly from burst pipes, roof leaks, storm damage, or even a sprinkler system malfunction. These events not only cause structural harm but can also damage inventory, electronics, and essential business equipment.

PDQ Restoration helps business owners navigate the commercial water damage insurance claim process by:

- Inspecting and documenting all affected areas.

- Coordinating with adjusters to ensure water, mold, and structural issues are fully covered.

- Providing complete commercial water damage restoration, from water extraction and drying to rebuilds.

Our goal is to reduce downtime and get your business operating safely as quickly as possible.

Commercial Fire Damage Insurance Claims

Fires in commercial properties often result in both fire and water damage due to suppression efforts. Filing a commercial fire damage insurance claim can be complicated, as insurers may question whether losses are fire-related, water-related, or both.

PDQ Restoration supports your business by:

- Documenting fire, smoke, soot, and secondary water damage.

- Working with adjusters to streamline the claims process.

- Providing restoration for structures, inventory, documents, and equipment.

With our expert fire damage insurance claim tips, you’ll be better positioned to get full coverage for structural repairs, contents restoration, and business interruption expenses.

Insurance Claim Assistance for Businesses

Handling a commercial damage insurance claim requires detailed reporting and constant communication with your insurer. PDQ Restoration’s specialists know how to present your case for maximum coverage. We provide:

- Direct insurance billing.

- Detailed inspections and estimates.

- Contents pack-out, cleaning, and storage for damaged business items.

- Support with both water damage insurance and fire-related claims.

✅ Bottom line: Whether you’re filing a commercial water damage insurance claim or a commercial fire damage insurance claim, PDQ Restoration has the expertise to protect your property, minimize business interruption, and help you recover faster.

Frequently Asked Questions about Commercial Damage Insurance Claims

Commercial water damage and fire damage can disrupt operations and cause major financial loss if not addressed quickly. Acting fast is the key to protecting your property, inventory, and bottom line. Below are some of the most common questions business owners ask our experts about commercial water damage insurance claims and commercial fire damage insurance claims.

The most common commercial insurance claims involve commercial water damage insurance claims and commercial fire damage insurance claims. Water damage often comes from burst pipes, roof leaks, storms, or sprinkler malfunctions, while fires can cause smoke, soot, and water damage from suppression efforts. Other frequent claims include storm damage, vandalism, and business interruption losses. In New Jersey, companies like PDQ Restoration help businesses handle the commercial damage insurance claim process by documenting losses, working with adjusters, and restoring property to reduce downtime.

Commercial property damage insurance protects businesses from financial losses when their property is damaged by events like fire, water damage, storms, theft, or vandalism. It typically covers the building, inventory, equipment, and other business assets. When a disaster occurs, a commercial damage insurance claim can be filed to repair or replace damaged property and help reduce business interruption. In New Jersey, specialists like PDQ Restoration assist business owners with commercial water damage insurance claims and commercial fire damage insurance claims, ensuring losses are fully documented and restoration is handled quickly.

Commercial claims refer to insurance claims filed by businesses after property damage, loss, or disruption caused by events like water damage, fire, storms, theft, or vandalism. A commercial damage insurance claim allows a business to recover costs for repairing buildings, replacing equipment or inventory, and covering business interruption expenses. Companies like PDQ Restoration in New Jersey help streamline commercial water damage insurance claims and commercial fire damage insurance claims so businesses can get back up and running quickly.

The four most common commercial insurance claims are:

- Water damage claims – from burst pipes, roof leaks, storms, or sprinkler malfunctions.

- Fire damage claims – including fire, smoke, soot, and water damage from suppression efforts.

- Storm damage claims – caused by wind, hail, or severe weather events.

- Theft or vandalism claims – covering stolen or damaged property.

These events often lead to significant losses, and filing a commercial damage insurance claim helps businesses recover property, inventory, and equipment costs while minimizing downtime.