Does Homeowners Insurance Cover Fire Damage? What You Need to Know

When fire damages your home or belongings, one of the first questions is: Does homeowners insurance cover fire damage? The good news is that in most cases, fire is one of the perils specifically covered under both homeowners and renters insurance. However, getting a fair payout often depends on how you handle your fire damage insurance claim

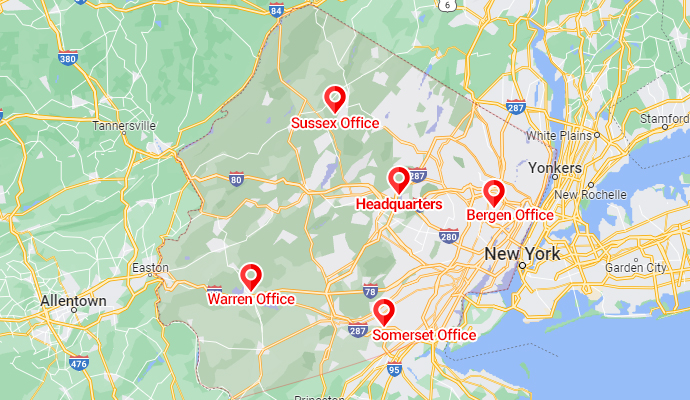

At PDQ Restoration, we’ve helped countless New Jersey families navigate the insurance process after fire and smoke disasters. Below, we’ll explain what’s covered, what’s not, and share practical fire damage insurance claim tips to help you get the full coverage you deserve.

Does Homeowners Insurance Cover Fire Damage?

Yes—homeowners insurance typically covers fire damage to your home, attached structures (like garages), and personal property. Most policies also include coverage for additional living expenses (ALE) if you can’t stay in your home during repairs.

Covered costs often include:

- Structural repairs to walls, roofing, and flooring.

- Replacement of furniture, clothing, and electronics.

- Smoke and soot cleanup.

- Water extraction and drying (since water is used to put out fires, water damage insurance may also apply).

The key is filing your claim quickly and documenting all losses clearly to avoid disputes.

Does Renters Insurance Cover Fire Damage?

If you’re renting, you may wonder: Does renters insurance cover fire damage? The answer is yes—for your personal belongings. Renters policies cover items like clothing, furniture, and electronics damaged by fire or smoke.

However, repairs to the building itself are the landlord’s responsibility under their own insurance policy. If your apartment becomes uninhabitable, renters insurance may also cover temporary housing and living expenses.

Common Causes of Fire Damage Insurance Claims

Fires can start in many different ways, and each situation can lead to a fire damage insurance claim. Some of the most common causes we see include:

- Kitchen fires– Grease fires, unattended cooking, or electrical stove malfunctions often cause severe smoke and fire damage.

- Electrical fires– Faulty wiring, overloaded outlets, or old appliances can spark hidden fires behind walls or in attics.

- Heating equipment– Space heaters, fireplaces, and furnaces are leading sources of household fires.

- Accidental ignition– Candles, cigarettes, and mishandled matches can quickly ignite nearby furniture or carpeting.

- Storm or utility issues– Lightning strikes or power surges can trigger electrical fires.

- Wildfires– In certain regions, homes are at risk from rapidly spreading outdoor fires.

Each of these incidents can lead to major property loss, smoke contamination, and even water damage from firefighting efforts—making a well-documented fire damage insurance claim critical for full recovery.

Fire Damage Insurance Claim Tips

To improve your chances of success, follow these steps when filing a claim:

- Report immediately – Call your insurer as soon as it’s safe.

- Document everything – Take photos, videos, and detailed lists of all damaged items.

- Request a full inspection – Smoke and soot often cause hidden damage.

- Save receipts – Keep records for temporary housing and repairs.

- Work with PDQ Restoration – Our experts handle inspections, cleanup, and direct communication with your adjuster.

These fire damage insurance claim tips can make the difference between a partial payout and full coverage.

Frequently Asked Questions about Fire Damage Insurance Claims

When fire strikes your home, one of the first questions is: Does homeowners insurance cover fire damage? The answer is often yes, but the details depend on your policy language, the extent of the fire, and how the damage is documented.

At PDQ Restoration, we help New Jersey homeowners and renters navigate the complex process of fire damage insurance claims. From kitchen and electrical fires to smoke contamination and water damage from firefighting, we’ll guide you through what’s typically covered—and how to avoid the common pitfalls that insurance companies use to minimize payouts.

A fire damage insurance claim starts as soon as you notify your insurance company of the loss. After you file, the process generally works like this:

-

Emergency response & mitigation – You are required to take reasonable steps to prevent further damage (such as boarding up windows, tarping the roof, or starting smoke cleanup). These costs are often reimbursable under your fire damage insurance claim.

-

Insurance adjuster inspection – Your insurer assigns an adjuster to inspect the fire scene, review the cause, and estimate the cost of repairs and replacements.

-

Proof of loss submission – You must provide a detailed inventory of all damaged items, including approximate values. The more thorough this list, the stronger your claim.

-

Policy review & coverage determination – The insurer compares your losses to your policy’s limits, exclusions, and endorsements to determine what they’ll cover.

-

Payment & restoration – Once approved, payment is issued (either directly to you or your contractor) to cover cleanup, repairs, and replacement of personal property.

Helpful tip: Many policies also include Additional Living Expenses (ALE) coverage. This means if your home is uninhabitable, insurance may pay for hotel stays, rental housing, meals, and even pet boarding until repairs are complete.

Another overlooked benefit: if both fire and water damage occurred (from firefighting efforts), your claim may be categorized under both, which can expand coverage.

In short, a fire insurance claim is more than just cleanup—it’s about documenting everything, understanding policy benefits like ALE, and making sure hidden damage (like smoke in HVAC systems) is included in your payout.

The timeline for a fire damage insurance claim can vary, but most homeowners receive an initial payment within 30 to 60 days of filing—provided documentation is submitted quickly. Complex claims, such as those involving structural rebuilding or extensive smoke damage, may take several months or longer to fully settle.

Several factors affect how fast you get paid:

-

Completeness of documentation – A detailed proof of loss (with itemized lists, receipts, and photos) speeds up approvals.

-

Adjuster workload – After large community fires, adjusters may be backlogged, delaying inspections.

-

Policy complexity – If your claim involves both fire damage and water damage insurance (from firefighting efforts), extra review may be required.

-

Disputes – If the insurer questions the cause of the fire or the value of your losses, payments can be delayed until the issues are resolved.

Helpful tip: Most policies allow for advance payments —partial funds released before the claim is finalized. These can cover immediate needs like temporary housing, clothing, and emergency repairs. Ask your adjuster about this option so you don’t have to wait for the full settlement to begin recovery.

In short, while every case is different, being organized, acting quickly, and asking about advance payouts can help you access your fire damage insurance claim funds much faster.

After you file a fire damage insurance claim, your insurance company assigns an adjuster to investigate and estimate the loss. Their role is to protect the insurer’s interests while determining how much they’ll pay out.

Here’s what an adjuster typically does after a fire:

-

Inspects the property – They assess structural damage, smoke contamination, and even secondary water damage from firefighting efforts.

-

Determines the cause – They review fire reports and evidence to confirm whether the fire was accidental, intentional, or due to negligence.

-

Calculates repair costs – Using industry software, they estimate the cost to restore your home to pre-loss condition.

-

Reviews your policy – They compare your losses against coverage limits, exclusions, and deductibles.

-

Negotiates settlement – The adjuster presents the insurer’s offer, which may not reflect the full cost of cleanup and repairs.

Helpful tip: While the adjuster works for the insurance company, you have the right to bring in your own experts —such as contractors, restoration specialists, or a public adjuster—to provide independent estimates. This ensures hidden damage (like smoke in HVAC systems, electrical issues, or lingering odors) isn’t overlooked.

In short, an insurance adjuster’s job is to evaluate your claim, but it’s up to you to make sure all losses are fully documented so your fire damage insurance claim covers everything you’re entitled to.

Why Choose PDQ Restoration for Insurance Claim Help?

At PDQ Restoration, we know how stressful fire damage can be. That’s why we handle both fire damage cleanup and the complicated insurance claim process. Our team will:

Our team will:

-

Inspect and document fire, smoke, and water damage.

-

Provide detailed reports and photos for your insurer.

-

Negotiate directly with your adjuster.

-

Restore your home safely and quickly.